By Johnny Liberty

The Federal Reserve Bank (FRB) was originally based on the Vatican’s Canon law, and the principles of sovereignty established by the Declaration of Independence and codified in the U.S. Constitution with the Bill of Rights.

Federal Reserve as Joint Stock Trust

In fact, the private international bankers used a “Canon Law Trust” as their model, adding private stock and renaming it as a Joint Stock Trust. Eric Madsen asserted that it was a type of corporation.

In 1873, the U.S. Congress had passed a law making it illegal for any legal “person”to create a Joint Stock Trust. The Federal Reserve was legislated post-facto to 1870, despite the fact that post-facto laws were strictly forbidden by the U.S. Constitution [1:9:3].

“This [Federal Reserve Act] establishes

the most gigantic trust on Earth.

When the President [Wilson] signs this bill

the invisible government of the Monetary Power will be legalized…

the worst legislative crime of the ages will be perpetrated by

this banking and currency bill.”

~ Congressman Charles A. Lindbergh, Sr. (1913)

To this day, the Federal Reserve Bank (FRB) remains a United States, European and Global Power structure separate and distinct from the federal U.S. government corporation operating entirely outside the bounds of the U.S. Constitution.

The Federal Reserve Bank (FRB) is a maritime lender and insurance underwriter to the federal U.S. government corporation, that operates exclusively under international “Admiralty/Maritime” law.

The maritime lender or insurance underwriter bears all the risks, and Admiralty/Maritime law compels specific performance by paying the annual interest due, or insurance premiums.

All the assets of the debtor nation state, such as the federal U.S. government corporation, can be “hypothecated”, in other words, pledged as security to pay the federal /national debt by the maritime lender or insurance underwriter. Alarmingly, all the assets of the people of the united states have been “hypothecated” against both present and future “debt (Ø)” that is to be paid one day whenever the note is called.

The Federal Reserve Act of 1913 stipulated that the interest on the federal/national debt was to be paid in gold not in “paper money substitutes (Ø)”. There was no stipulation in the Federal Reserve Act whatsoever for ever paying down the principle on the loan. Thus, an un-payable federal/national “debt (Ø)” was instituted from the inception of the Act. Indeed, this seems crazy, but it is true.

The Federal Reserve Act was never challenged in a U.S. court of competent jurisdiction which would be have been under “Admiralty/Maritime” law.

The Federal Reserve Bank (FRB) is a sovereign Joint Stock Trust fully independent of the federal U.S. government. It does not file a tax return or pay any “taxes”. It is not subject to Title 5, USC or to the scrutiny of the General Accounting Office (GAO). It had never filed statements of assets on any information form until recently kudos to former U.S. Congressmen Ron Paul (R-TX).

“Federal Reserve bonds, including the

capital stock and surplus therein

and the income there-from,

shall be exempt from federal, state and

local taxation, except taxes upon real estate.”

~ 12 USC 531

Not Federal and Nothing in Reserve

The name of the Federal Reserve Bank (FRB), in other words, the “FED”, is deceptive. There is nothing “federal” about the Federal Reserve Bank (FRB) because it is not part of the federal U.S. government. In the Washington D.C. phone directories of yore, the Federal Reserve Bank (FRB) was never listed under U.S. government offices.

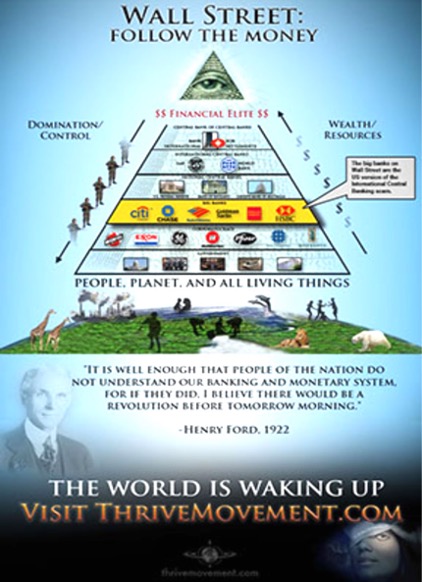

There is nothing held on “reserve” in the Federal Reserve Bank (FRB). They project the appearance of being a “system” of regional offices to shift the appearance of power away from Wall Street, but essentially the power is centralized in the Board of Governors. They are not a “bank” because they do not deal with real, constitutional “money ($)”, but only “fiat (Ø)” money.

The stated mission of the Federal Reserve Bank (FRB) was to stabilize banking, but if one analyzes their track record, it has not achieved the stated objectives. It was never the objective of the Federal Reserve Bank (FRB) in the first place. Instead it was a deceptive ploy to get the legislation passed and signed by the U.S. President with a minimum of resistance from the people.

The Federal Reserve Bank (FRB) did, however, achieve the cessation of private capital formation in the hands of We the People by eliminating both the gold (1934) and silver (1968) standards for domestic currency, thus centralizing the power of capital formation in the hands of private international banking cartels.

“The main purpose for establishing

a central banking system in the United States

of America was to ultimately confiscate

100% of the property and assets

of the American people.”

~ Johnny Liberty

Passing the Federal Reserve Act

The Federal Reserve Act of 1913 was passed over a Christmas vacation on December 22, 1913 with merely ten legislative members in session. This was hardly a legal quorum for passing legislation by any stretch of the imagination.

Most of the U.S. Congress was adjourned for the Christmas holidays. Furthermore, “U.S. citizens”, sovereign “state” Citizens, Congress and the President had been fooled by a well-orchestrated propaganda and media campaign into believing that the private international bankers and the Wall Street “money trust” were opposed to the legislation.

Through clever political manipulation, propaganda and a knee-jerk reaction by the press, many of our leaders walked into a well-designed trap to support the Federal Reserve Act of 1913 despite its lack of legal quorum. U.S. President Woodrow Wilson signed the Act under considerable pressure and later regretted his signing the Act by saying. “I am a most unhappy man, unwittingly I have ruined my country.”

“The [Federal Reserve Act] as it stands seems to me to open the way to a vast inflation of the currency…I do not like to think that any law can be passed that will make it possible to submerge the gold standard in a flood of irredeemable paper currency.” ~ Henry Cabot Lodge, Sr. (1913)

We the People Were Our Own Bankers

Before the Federal Reserve Act of 1913 was passed into law, many people owned their own land free and clear of any bank liens, encumbrances or mortgages. We retained sovereign“allodial” title to property with all rights therein.

Conventional mortgages, where one could borrow money to pay for a piece of land or property over the course of thirty years, did not exist. This turned out to be yet another not so subtle property confiscation scheme.

Prior to the Act, one simply acquired land by assignment from a previous owner with a Bill of Sale, paid for in gold or silver coin or notes, then updated the “land patent“and received the true, lawful “allodial” title,which is absolute title and ownership to the land. Back then, land was not registered or recorded via an “equitable deed”.

> HYPOTHECATE – To pledge something as a security without taking possession of it.

After the Federal Reserve Act of 1913, all land and property within the federal U.S.was “hypothecated” to the Board of Governors as “Trustees” of the Federal Reserve Banking System cartel. In any Trust, the “Trustees” hold legal title, and have control over the assets of the third party or the “Beneficiaries”.

> RE-VENUE – To shift jurisdiction from one “venue” or place to another; to shift the jurisdiction from the Republic of the united states of America to the Democracy of the federal United States corporation.

Venue and Citizenship

All that remained to seal the deal was to “re-venue” all sovereign “state” Citizens, along with their land, assets and property, then pursuant to the “Common law” jurisdiction of the united states of America, into the exclusive jurisdiction of the federal U.S. government corporation pursuant to the “Municipal law” of the District of Columbia (D.C.).

Today, the common meaning of “re-venue” is synonymous with “income”. The private international bankers, with the cooperation of the political establishment in Washington D.C., shifted the jurisdiction from one “venue” or place (united states of America) to another (District of Columbia).

After the bankers morphed the meaning of “venue”, they shifted the meaning of “citizens of the United States” from sovereign “state” Citizenship to U.S. citizenship. It was a clever, well-orchestrated slight-of-hand – a magician’s trick.

After the bankers shifted the meaning of citizenship, they made all the people believe that they were subject to paying the federal/national debt of the federal U.S. corporation pursuant to the 14th Amendment of the U.S. constitution, from that day forward, made payable to the Federal Reserve Bank (FRB) via the “income tax”.

U.S. Government Received Unlimited Credit Line

Under the terms of the Federal Reserve Act, the Federal Reserve Bank (FRB) agreed to extend the federal U.S. government an “unlimited credit line” (paper money substitute (Ø)). The “United States” would be loaned all the funds needed by the Federal Reserve Bank (FRB) to expand the power and reach of the federal “United States” empire indefinitely.

Like any other debtor borrowing money from a creditor, the federal U.S. government had to assign collateral and security to their creditors as a condition of the loan. So what did it do?

Since the federal U.S. government did not have any significant assets in 1913, except a small modicum of public property, the government “hypothecated” all the private land and property of their “economic slaves” (U.S. citizens), as collateral (security) against the perpetually, un-payable federal/national debt.

The federal U.S. government, along with their principals/creditors, needed a legal contractual nexus to lure more U.S. citizens and sovereign “state” Citizens into their venue under their jurisdiction, in order to expand the pool of land and property that they could hypothecate, attach and lien. So how did they accomplish this?

By manufacturing wars (WWI, WWII and WWIII), recessions and depressions such as the Great Depression, and then luring people into the Social Security Act of 1938. This not so subtle “conspiracy” created the “welfare state”, accomplished the objectives in less than three generations.

In addition to land and property, the federal U.S. government “hypothecated” and pledged the assets of unincorporated federal territories, national parks and forests (clear-cutting forests is a environmental policy for federal debt reduction), birth certificates (each baby child is registered as property under the U.S. Department of Commerce), as well as all for-profit and non-profit corporations (all equity is owned by the Internal Re-Venue Service), as collateral to the Federal Reserve Bank (FRB)x.

Lastly, but not finally, these “co-conspirators” legislated a 1% federal income tax on corporations and U.S. persons (U.S. citizens and federal U.S. employees) to pay the “interest-only” on this expanding federal/national “debt (Ø)”. In 1913, less than 1% of the people and corporations paid any federal income taxes. This original income tax was effectively repealed by the Internal Revenue Act of November 23, 1921.

“The regional Federal Reserve Banks

are not government agencies.

…but are independent, privately owned and

locally controlled corporations.”

~ Lewis v. United States, 680 F.2d 1239 (9th Cir. 1982)

The Federal Reserve Bank (FRB) is a very private, foreign entity controlled by a cartel of private international bankers. The Federal Reserve Bank (FRB) can sue and be sued in their name, unlike actual government agencies. Each of the regional Federal Reserve Banks (FRB) carries its own liability insurance.

Each conducts its daily activities without any direction from the federal U.S. government. Each pays local property taxes and postage, which is even more evidence of private ownership. Each had listings in telephone directories, but never under U.S. government listings.

The actual “joint stock holders” of the Federal Reserve Bank (FRB) are held by domestic, foreign, and international central banks. According to archival sources, the following list does not reflect the actual ownership.

- The Rothschild’s of London and Berlin.

- The Lazard Brothers of Paris.

- Israel Moses Seif of Italy.

- Warburg Bank of Hamburg, Germany and Amsterdam.

- Kuhn, Loeb and Co. of Germany and New York.

- Lehman Brothers of New York.

- Goldman Sachs of New York.

- Chase Manhattan Bank of New York

- The Rockefeller Brothers of New York.

Formal Charges Against Federal Reserve

On May 23, 1933, U.S. Congressman, Louis T. McFadden, brought formal charges against the Board of Governors of the Federal Reserve Bank (FRB), the U.S. Comptroller of the Currency, and the Secretary of the U.S. Treasury for numerous criminal acts, including but not limited to, conspiracy, fraud, unlawful conversion, and treason. The following is a quote from McFadden’s famous address to the U.S. Congress in 1934.

“Mr. Chairman, we have in this Country one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board and the Federal Reserve Banks, hereinafter called the FED.

The FED has cheated the Government of these United States and the people of the United States out of much more than enough money to pay the Nation’s debt. The depredations and iniquities of the FED has cost enough money to pay the National debt several times over.

This evil institution has impoverished and ruined the people of these United States. The FED has bankrupted itself, and has practically bankrupted our Government. It has done this through the defects of the law under which it operates, through the mis-application of that law by the Fed and through the corrupt practices of the moneyed vultures who control it. Some people think that the Federal Reserve Banks are United States Government institutions.

[To the contrary] they are private monopolies which prey upon the people of these United States for the benefit of themselves and foreign customers; foreign and domestic speculators and swindlers; plus rich and predatory money lenders.

In that dark crew of financial pirates, there are those who would cut a man’s throat to get a dollar out of his pocket; there are those who send money into states to buy votes to control our legislatures; there are those who maintain international propaganda for the purpose of deceiving us into granting of new concessions which will permit them to cover up their past misdeeds and set again in motion their gigantic train of crime.”

References:

- Wikipedia | History of the Federal Reserve; | Federal Reserve | Who owns the Federal Reserve? “The Board of Governors in Washington, D.C., is an agency of the federal government and reports to and is directly accountable to the Congress.” Federal Reserve SF | Is the Federal Reserve a privately owned corporation? ; Facts Are Facts | The Federal Reserve is privately owned. Citation Needed | Federal Reserve is a Joint Stock Company Trust; Wikipedia | Canon Law; Canon Law Trust.

- Citation Needed | Joint Stock Trust Illegal in 1863; Constitution Congress | U.S. Constitution [1:9:3]; No Bill of Attainder or ex post facto Law shall be passed.

- Wikipedia | Charles A. Lindbergh, Sr.

- Wikipedia | Admiralty/Maritime Law (federal courts derive their exclusive jurisdiction over this field from the Judiciary Act of 1789 and from Article III, § 2 of the U.S. Constitution; Congress regulates admiralty partially through the Commerce Clause.

- Wikipedia | Federal Reserve Act of 1913 (text) www.federalreserve.gov/generalinfo/fract/ (text laid out in USC) www.law.cornell.edu/uscode/html/uscode12/usc_sup_01_12_10_3.html; Banking Act of 1933 and Federal Open Market Committee purpose to “promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates” (12 USC §225a).

- “Federal reserve banks,…shall be exempt from Federal, State, and local taxation, except taxes upon real estate.” (12 USC §531).

- Brainy Quote | U.S. President Woodrow Wilson.

- Brainy Quote | Henry Cabot Lodge, Sr.

- Legal Dictionary | Definition of hypothecation.

- New definition of “re-venue” by this author.

- Wikipedia | Revenue Act of 1913; Statutes at Large for 1921, p.227 www.constitution.org/uslaw/sal/042_itax.pdf

- Wikiquote | “Federal Reserve Bank is not a federal agency…Each Federal Reserve Bank is a separate corporation owned by commercial banks in its region”; Lewis v. United States, 680 F.2 1239 (9th Cir. 1982) www.leadershipbygeorge.blogspot.com/2011/11/federal-reserve-is-private-corporation.html

- Ownership of the Federal Reserve Bank. Kuhn Loeb and Co. got its start by exploiting Indians and setting up trading posts for the pioneers; anecdote about Kuhn and Loeb sourced from Free At Last by N.A. Scott, Ph.D., D.D., pp.4-39 (federal reserve is not part of the federal government) www.rainbowwarrior2005.wordpress.com/2008/09/29/federal-reserve-owners-and-history/

- The House of Rothschid by Nial Ferguson: Amazon

- Speech on Federal Reserve from Louis T. McFadden in the U.S. Congress www.scribd.com/doc/16502353/Congressional-Record-June-10-1932-Louis-T-McFadden

Source: Sovereign’s Handbook by Johnny Liberty (30th Anniversary Edition), Volume 2 of 3, p.30 – 35

ORDER YOUR LIBERTY BOOKS TODAY!

Sovereign’s Handbook by Johnny Liberty

(30th Anniversary Edition)

(3-Volume Printed, Bound Book or PDF)

A three-volume, 750+ page tome with an extensive update of the renowned underground classic ~ the Global Sovereign’s Handbook. Still after all these years, this is the most comprehensive book on sovereignty, economics, law, power structures and history ever written. Served as the primary research behind the best-selling Global One Audio Course.Available Now!

$99.95 ~ THREE-VOLUME PRINT SERIES

$33.33 ~ THREE-VOLUME EBOOK

Dawning of the Corona Age: Navigating the Pandemic by Johnny Freedom

(3rd Edition)

(Printed, Bound Book or PDF)

This comprehensive book, goes far beyond the immediate impact of the “pandemic”, but, along with the reader, imagines how our human world may be altered, both positively and negatively, long into an uncertain future. Available Now!

$25.00 ~ PRINT BOOK

$10.00 ~ EBOOK